Insurance law

There is insurance for every risk. But who will cover your insurance risk?

The insurance industry is one of the largest sectors in Germany. Choosing the right insurance to cover the right risk and claim the right benefits when an insured risk occurs can be of existential importance for SMEs. To ensure that there are no unpleasant surprises when choosing the right insurance, we offer you comprehensive information and advice.

Why is insurance law so important?

In an emergency, things can quickly become unpleasant between the policyholder and the insurance company. In order to receive the agreed service (especially in private insurance law), you sometimes have to be persistent. This means a lot of effort for something that you are actually entitled to. This is where insurance law comes into play. In order to be able to use insurance law in a targeted manner, a distinction must be made between private insurance law and social security law. We support you in enforcing your claims.

What is the difference between private insurance law and social security law?

The main difference between private insurance law and social security law is the general insurance relationship. While private insurance law is based on a contract, social security law is based on the legislation. If you look at the legal relationships, it quickly becomes clear whether you are dealing with private insurance law or social security law. Another key difference is the principle of coverage. In private insurance law, cover and costs are primarily determined by the risk to be insured, whereas in social security law they are determined by the individual’s ability to pay.

What areas does private insurance law cover?

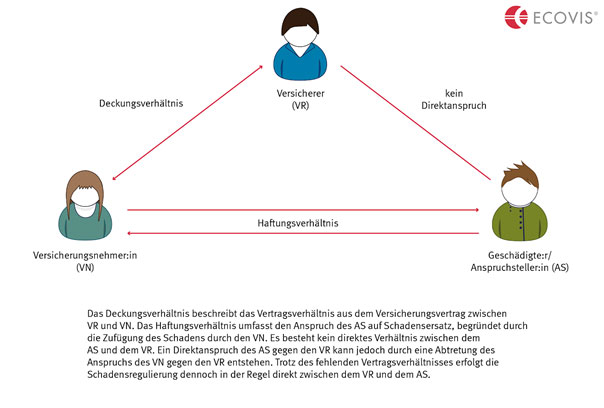

Private insurance law essentially governs the relationship between the policyholder or the insured person and the insurance company. It essentially comprises insurance contract law, insurance company law and insurance supervision law. In the event of problems, the Insurance Contract Act (VVG) is primarily consulted, supplemented by the terms and conditions of the insurance companies and the content of the specific insurance contract.

What areas does social security law cover?

Social security is a compulsory insurance prescribed by the legislation in Germany for persons who are in an employment, service or training relationship. It covers risks that could jeopardize the existence of the insured person and the community of insured persons. The community of insured persons is also referred to as a community of solidarity, as all insured persons finance the insurance with their contributions. In contrast to private insurance, such as private accident or occupational disability insurance, a membership of social security is compulsory. Social security in Germany consists of five pillars (unemployment insurance, pension insurance, health insurance, nursing care insurance and accident insurance).

What advantages do you have with experienced experts in insurance law?

Our experts in insurance law have acquired a valuable wealth of experience through their diverse activities. Our primary goal is to provide entrepreneurs with reliable advice on insurance law issues and to help them enforce their claims. We advise both preventively and in the event of a claim with the highest level of professional competence.

Specifically, we examine which approach promises the greatest possible success for you. Our focus is not only on your legal interests, but also on your economic and result-oriented interests. As commercial lawyers, we focus exclusively on practicable, efficient and realistic solutions.

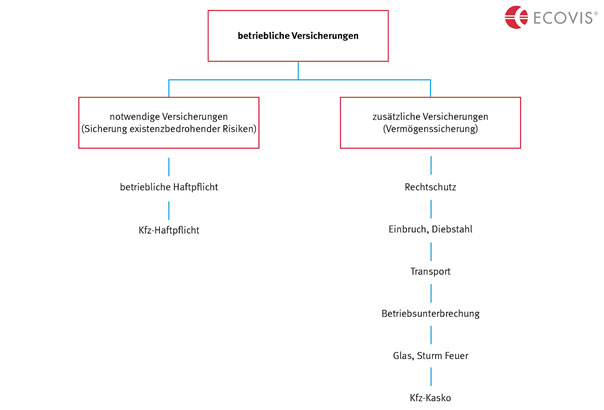

Do you actually have an overview of all the important company insurances?

What does insurance law cover?

Major risks

Not only consumers, but also companies need comprehensive insurance cover. The financial risk associated with loans, guarantees, trade, transportation and mining is high. However, the best promises are useless if the insurer does not pay out in the event of a claim or the risks of the company are not adequately covered. This can be due to poor advice from the insurer or unawareness. We are your point of contact to ensure that your risks are adequately covered and that your claims are enforced in the event of damage.

Our approach is to legally assess your major risks and discuss suitable insurance constellations. With our experience and independent view, we always maintain an overview for you. So you will be prepared for all eventualities.

Liability of corporate bodies – D&O / E&O insurance and professional liability

D&O insurance is the top priority for company bodies. D&O stands for Directors & Officers Liability Insurance. Roughly translated, this means corporate or managerial liability insurance.

E&O insurance (Errors & Omission) is a financial loss liability cover. It helps companies to protect themselves against third-party claims. Be it due to negligent or grossly negligent breaches of duty by employees or other bodies.

Professional liability insurance has become an integral part of entrepreneurial activity. A lot of money is at stake if company bodies and managers are to be financially protected against risks. In the event of a claim, however, the business and social reputation of those affected also suffers.

Nevertheless, insurers try to exempt themselves from liability through contractual clauses on intent and gross negligence. Our experts examine the circumstances and help you to obtain insurance cover and enforce your claims.

What is insurance supervisory law?

Businesses in the insurance industry are subject to a large number of regulations in Germany. Even in international legal transactions, the legal situation regarding licenses, permits and professional certificates is sometimes difficult to keep track of. The European Economic Area offers limitless opportunities to expand your business in the course of freedom of establishment and freedom to provide services. Leave nothing to chance and have your business project checked in accordance with commercial law.

Recourse proceedings and coverage process

In case of damage, there is no more room for error. Now you need to keep your cool and, ideally, have strong partners at your side. We effectively evaluate your procedural options in insurance law. Together, we will find solutions so that the opposing insurer and your own insurer accept and settle the claim.

Product liability, liability for construction services, planning damage and property damage

Accidents occur on a wide variety of scales. Depending on the sector, liability in industry, the construction industry or in the event of accidents is strictly regulated according to presumption or even without apportion of fault. Existences are at stake when liability insurers try to avoid taking responsibility. We are happy to remind your insurer of its contractual obligations and will not let you down.

What additional services do we offer?

The above individual areas of our services also include:

- Legal assessment of the scope of your insurance cover

- Examination of insurance contracts and policies

- Representation in and out of court in legal disputes with insurers and third parties

Act now and contact us so we can work out a joint solution for your company and your capital in the area of insurance law.