Procedural documentation

Procedural documentation must be available for tax audits

The tax authorities in the country are to be taken seriously. As an entrepreneur, you face the threat of high additional assessments during the next tax audit if you are unable to present organizational documents, procedural documentation as well as basic digital records. This is the case because the tax authorities require you to document all of your company’s accounting and tax-relevant processes, controls and procedures. If you do not – or cannot – provide this, you could be in for some unpleasant surprises. Many tax auditors are already requesting procedural documentation when sending out audit requests.

In short: entrepreneurs need procedural documentation – there is no “grace period” for fulfilling this obligation!

What is procedural documentation?

Procedural documentation describes in detail how your accounting is built. It also describes the structure, workflow and organization of your company and your individual business processes. Basically, everything that is relevant for financial accounting and taxation must be summarized in the procedural documentation and be available in writing. This also includes, for example, documents relating to merchandise management, e-mail correspondence with an accounting reference, documents relating to payroll accounting and time recording in your company.

Do I need a procedural documentation?

The unambiguous answer is yes. Every taxpayer with profit income within the meaning of §§ 5, 4 para. 1 EStG must prepare procedural documentation and be able to submit it in writing in the event of questions from the tax authorities. This also applies to very small businesses! There are no exceptions based on size or industry.

The “Principles for the proper management and storage of books, records and documents in electronic form as well as for data access (GoBD)” have been in force since the beginning of 2015. If you violate the applicable GoBD, you may be subject to the severe additional assessments of up to ten percent of your annual turnover on your taxable profit, as described above.

Consequences of incorrect or incomplete procedural documentation

If there are no written records in your company, but rather incomplete records or even verbal instructions, an auditor from the tax office cannot gain an insight into the tax-relevant processes of your company. You are therefore violating the principles of traceability and verifiability. If there is no procedural documentation at all, you are also in breach of the GoBD. If you do not adhere to the requirements, this will usually result in high additional assessments by the tax authorities.

Always remember: You as the entrepreneur are solely responsible for the correctness of all accounting-related systems! This also applies if you transfer accounting and record-keeping obligations to third parties, such as tax consultants.

Therefore, our urgent advice: Do not give the auditors and therefore the tax authorities any reason to doubt the formal correctness of your accounting. Act now and create individual procedural documentation for your company with our help!

Development of procedural documentation

Procedural documentation must be designed in a way that a knowledgeable third party – in particular the auditors of the tax authorities – is able to obtain an overview of all business transactions in your company that are relevant for taxation within a reasonable period of time during a tax audit.

Structure and content of procedural documentation

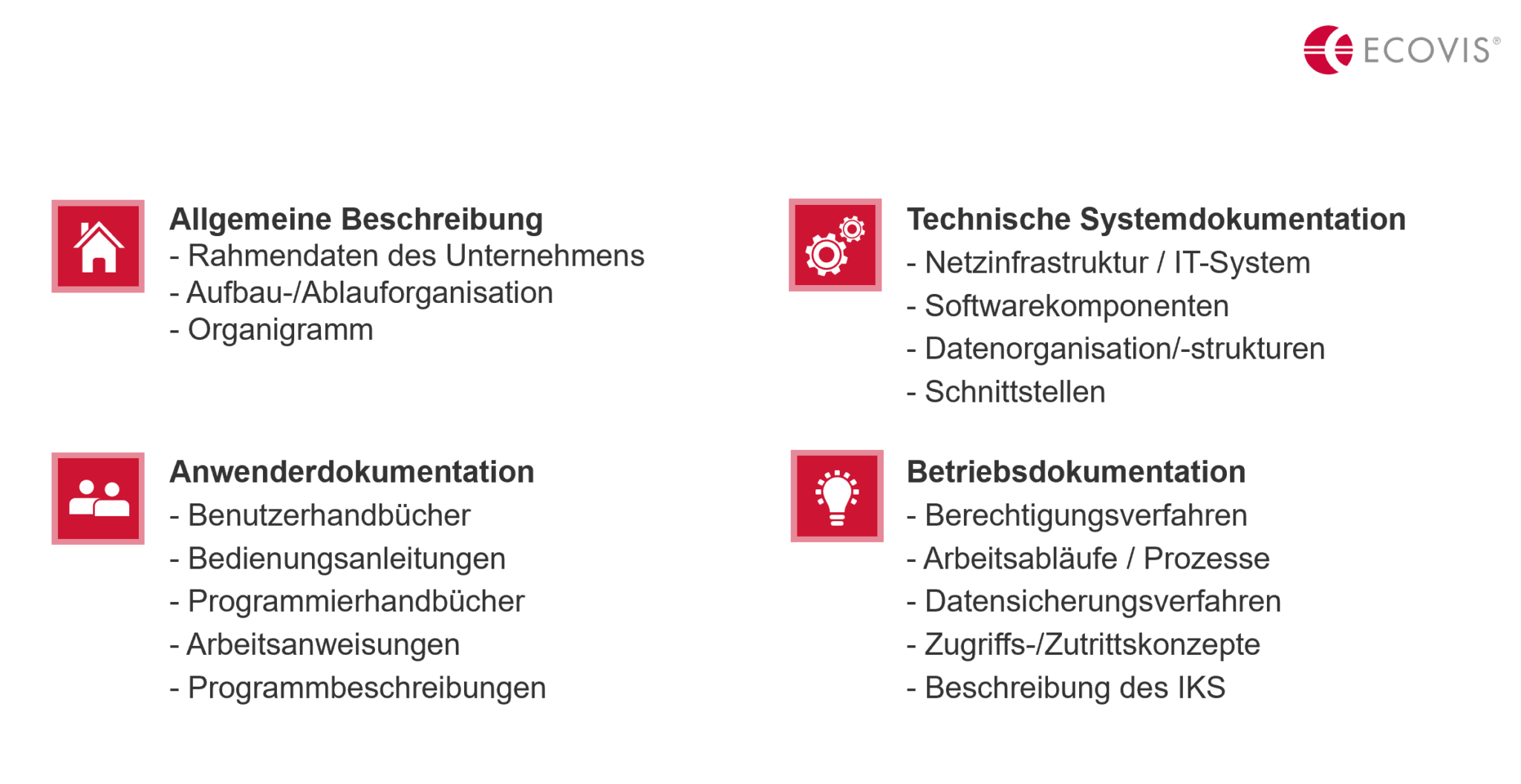

The first, general section describes the organization of your company. This section also answers the question of which employees are responsible for which tasks. In order to place your activities in a wider context, the sector in which you operate is also described. Finally, the operational environment is highlighted.

The following process description includes all processes relevant to tax law. Starting with ordering, order processing, invoicing, cash management, payment transactions, document organization, human resources, accounting as far as document archiving.

The user documentation lists the software that you use in your company. To prove that the programs are used correctly, the individual operating instructions for the software must also be stored in the process documentation.

The “technical system documentation” is a precise description of the IT environment in your company. Among other things, this must list the hardware you use, how networks are set up, which application service providers (ASP) you work with or which cloud applications you use.

In the procedural documentation, you must make specific statements on data protection and data security. In other words, how is data protected against unauthorized access (e.g. through encryption) and how is a backup performed to prevent data loss?

Finally, you have to describe how your internal control system (ICS) is structured.

If something changes in your processes, the systems or procedures that you use, you must document all changes in accordance with GoBD in terms of content and time without any gaps. This is the only way that third parties can understand and audit them.

Accounting-relevant IT systems that must be listed in the procedural documentation

- Financial, asset and payroll accounting

- Cash register system (PC or cash register, own cash register documentation for cash-intensive companies)

- Merchandise management and invoicing systems, order and project management, materials management

- Payment transaction systems

- Taximeters, gaming machines, electronic scales

- Cloud systems

- Document management systems, archive systems

- Driver’s logbook

- Time recording systems

- Invoice receipt book

- Onlineshop

- Interfaces

Entrepreneurs need procedural documentation – petrol stations, cabs as well as restaurants

There is a special feature for particularly cash-intensive companies such as petrol stations, the cab industry, restaurants and hotels, retailers, pharmacies, bakeries and butchers. Since January 1, 2018, they have been required to have procedural documentation for cash register management in addition to procedural documentation. Since then, the tax office has been allowed to carry out unannounced cash register inspections at the business premises.

However, other professional groups and sectors, such as freelancers, craftsmen or software manufacturers, must also deal with the issue of procedural documentation.

State support for procedural documentation for cash register management

At first, it sounds like a lot of work and high costs to introduce procedural documentation for cash management. However, there are state funding opportunities if companies take advantage of so-called “process consulting” in advance of the documentation. Another positive effect is that they not only comply with the requirements of the tax authorities, but also illuminate and optimize their own operational processes.

Opportunities of procedural documentation

Creating procedural documentation – whether on your own or with a professional partner such as ECOVIS – this always provides positive aspects for you and your company. This is because you are intensively involved with your company when creating procedural documentation. And we know from experience that every company has processes and structures that are not known to the management in detail or at all. So if you create procedural documentation, this is an opportunity for you as entrepreneur to deal with all the processes that exist in your company and to dive into them in depth.

What’s more, if you rely on the ECOVIS experts, active processes that have taken on a life of their own over the years will be scrutinized through our external “consulting glasses” and can afterwards be optimized in consultation with you. Risks can thus be minimized and efficiency gains can be developed.

It is also conceivable that the procedural documentation for tax purposes could serve as the basis for more extensive documentation. We are thinking of the development and documentation of a Tax Compliance Management System (TCMS). In this way, the management can avoid organizational culpability. Alternatively, the documented processes and structures can be expanded into a comprehensive company manual, which can be used for ISO certification or industry-specific regulations, for example.

Future digitalization, which can no longer be stopped, will make documentation obligations necessary in many areas. Start now and make your company future-proof.

You can find out more about the opportunities of procedural documentation in our magazine ECOVIS red. Download the article here as a PDF document.

Advantages of proper procedural documentation

In addition to checking that the programs used are audit-proof, processes can be optimized and efficiency might be increased. For example, new employees can be trained more easily. Work instructions or substitution rules become completely transparent through the introduction of procedural documentation. On this basis, a decision can be made as to whether they can be standardized and improved. In addition, existing risks in the operational process are highlighted. Here too, countermeasures can be taken.

In the long term, good procedural documentation improves your rating with banks, as the financial institutions can clearly and unambiguously understand how your company is structured. If you want to sell your company, a potential buyer will also be pleased to see exemplary procedural documentation – which puts you in a better sales position.

Special documentation software is used to achieve all of this.

In a guest article with our partner Taxdoo, Lars Rinkewitz focuses on the opportunities of procedural documentation.

Entrepreneurs need procedural documentation – rely on ECOVIS as a strong partner!

Process documentation is extremely important for your business. We therefore recommend that you rely on a professional partner like ECOVIS to set it up. Establishing process documentation on your own can also work – but don’t underestimate the effort involved, depending on the complexity of your company. Whether an online “procedural documentation generator” is sufficient as an alternative depends very much on the individual case. You should be suspicious if there is talk of “procedural documentation in five minutes” or “at the touch of a button”. Our experience tells us that this simply cannot work.

The software used for procedural documentation also has a decisive influence on the result. There are now a large number of different providers in this area. We have a strong partner at our side so that we are always up to date. We can also create and archive the procedural and cash register documentation ourselves in an audit-proof manner.

If you rely on ECOVIS as your partner for procedural documentation, our consultants will work with you to compile the required data and information. Our consultants then create the audit-proof procedural documentation for you as an entrepreneur on this basis. Special tools are used to make your work easier. Close cooperation with lawyers is also very often useful and necessary for such an important project. This is because topics such as data protection and money laundering should also be prepared in a legally compliant manner in the procedural documentation.

It is important to note that procedural documentation is an ongoing process. This is because separate, valid procedural documentation must be created for each assessment period. However, the effort involved is usually minimal. as only changes to processes and structures need to be listed.

Do not wait and contact us so that we can work together to develop a quick and legally compliant solution for your company when it comes to procedural documentation.