Support in the world of the healthcare professions – proactively and in partnership

In our commitment to the healthcare professions, our support extends far beyond the entire practice life. As demographic change progresses, the importance of the healthcare sector is increasing. The complexity in this area, particularly in regard to tax issues, is also constantly growing. This development can bring particular challenges and obstacles with it which, without sound advice, can lead to considerable additional tax payments.

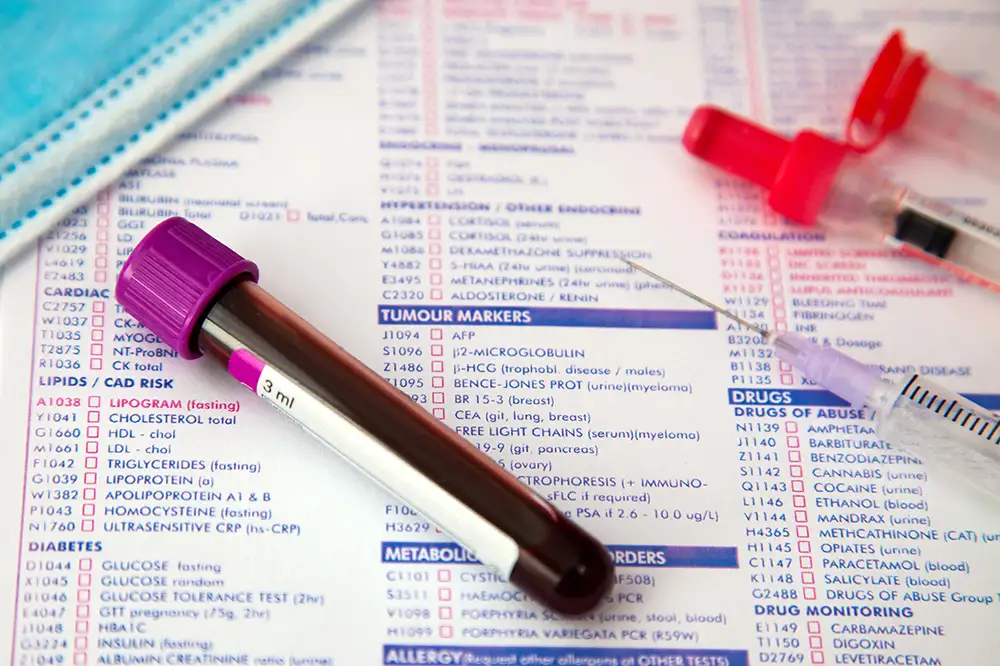

Comprehensive support throughout the healthcare sector

As your experienced partner in tax and legal advice as well as auditing, we offer a specialized team that provides comprehensive support for clients in the healthcare sector. Our clients stem from a wide range of professions in the healthcare sector, including self-employed as well as employed doctors and dentists, clinics, medical care centers, pharmacies, nursing services and consulting companies in the healthcare sector, as well as alternative practitioners, physiotherapists, psychotherapists and many other healthcare professionals.

Proactive advice and support – always one step ahead

Our financial accounting during the year always provides you with an up-to-date overview of your financial situation and the development of your practice. This allows us to intervene early and in a targeted manner if necessary. Careful monitoring of your tax prepayments is an important part of our services to protect you from unexpectedly high additional tax payments.

Support in digitalization and increasing efficiency

We are happy to support you in the digitalization of your practice, clinic or medical care center. In addition to business consulting in order to increase efficiency, you also benefit from our extensive network in the healthcare sector, which includes contacts to banks, medical law firms and other relevant stakeholders.

Our service portfolio – your key to success

We offer you a wide range of services that are individually tailored to your needs:

- Foundation and purchase advice for practices: We support you in the preparation of business plans and practice financing.

- Ongoing tax advice: Take advantage of our expertise in tax matters and corporate law issues.

- Financial and payroll accounting: Entrust us with your financial and payroll accounting and concentrate on your core business.

- Preparation of profit calculations/annual financial statements and tax returns: We ensure that your annual financial statements and tax returns are prepared correctly and on time.

We also offer the following services:

- Support during tax audits: When it comes to tax audits, we have expert support available to make this process smooth and efficient.

- Practice restructuring: If changes need to be made, you can count on us to help you restructure your practice in order to achieve maximum efficiency and productivity.

- Practice sale and valuation: When it comes to selling or valuing your practice, our professional advice and support is at your disposal. We will help you determine the fair value of your practice and efficiently manage the sale process.

- M&A in the healthcare sector: You can count on our comprehensive support in the complex field of mergers and acquisitions in the healthcare sector. Benefit from our profound knowledge of the industry to make strategic and profitable decisions.

With us at your side, you are able to concentrate on your responsible activities without any worries, while we handle your tax matters reliably and professionally.